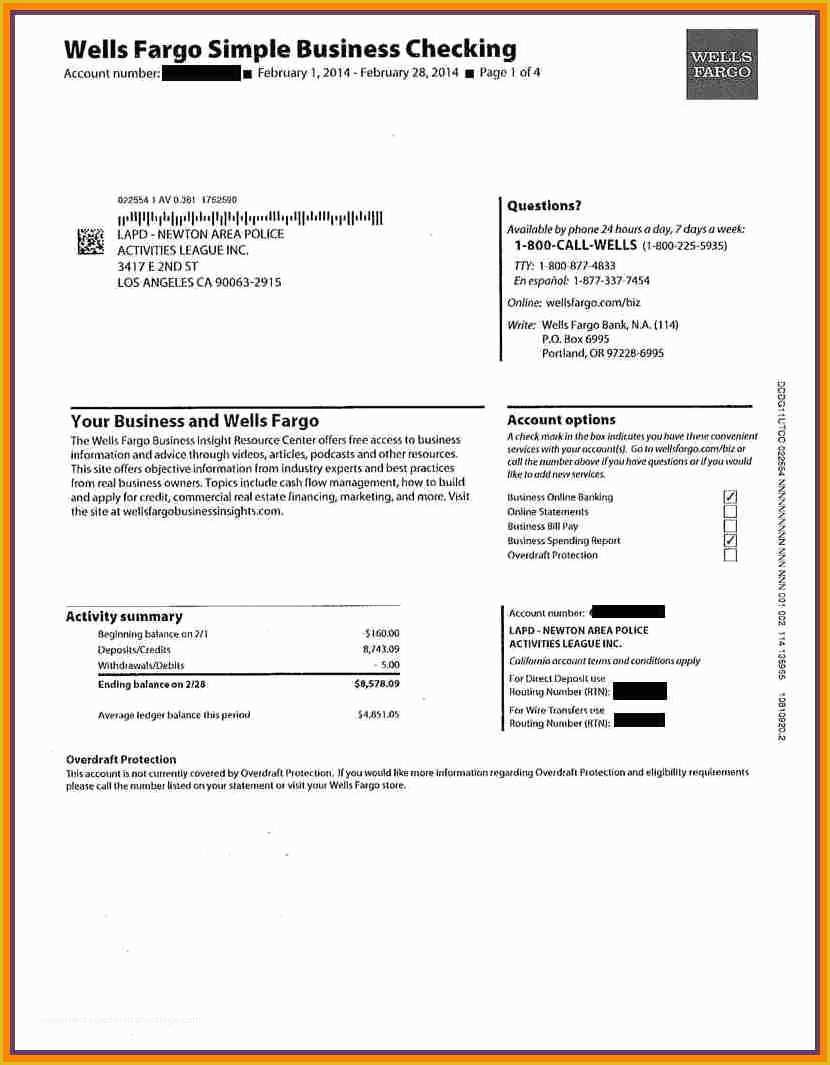

Bank statements are essential when applying for personal loans as they serve as proof of income. Details of each transaction-notably the amount, date, and payee-that took place in the bank account during the period will also be included, such as deposits, withdrawals, checks paid, and any service charges.įor example, a bank statement may show a non-interest-bearing checking account with a beginning balance of $1,050, total deposits of $3,000, total withdrawals of $1,950, an ending balance of $2,100, and zero service charges for the period Sept.

The bank statement will also contain account information and the statement date, as well as the beginning and ending balance of the account. Parts of a bank statement include information about the bank-such as bank name and address-as well as your information. They should keep monthly statements for at least one year. Account-holders usually have 60 days from their statement date to dispute any errors. If any discrepancies are found, they must be reported to the bank in a timely manner. This helps reduce overdraft fees, errors, and fraud. An account holder should verify their bank account on a regular basis-either daily, weekly, or monthly-to ensure their records match the bank’s records. They can help account holders track their finances, identify errors, and recognize spending habits. Licenseīank statements are a great tool to help account holders keep track of their money. It shows if the bank is accountable for an account holder’s money.

A bank statement is also referred to as an account statement. Account-holders must report discrepancies in writing as soon as possible. Below are some considerations.ĭuring the reconciliation of their bank account with the bank statement, account holders should check for discrepancies. How a bank statement works vary from country to country according to their laws and policies, Bank statement in the UK (England, Ireland), bank statement in France, Bank statement in Australia, Bank statement in Spain, Belgium, Europe, America, the woodlands. In addition, transactions on a statement typically appear in chronological order. Banks usually send monthly statements to an account holder on a set date. It allows the account holder to see all the transactions processed on their account. How a Bank Statement WorksĪ bank issues a bank statement to an account holder that shows the detailed activity in the account.

Feel free to contact for any bank transaction related documents you need. We have full access and connections with banks in America like Bank of America, wells Fargo Bank, Barclays, and other top-ranked banks. We know our way around perfect when it comes to creating bank statements, also you can buy a replacement bank statement from us, if you ever need to make a fake bank statement, how to make a fake bank statement you can always rely on our company.

0 kommentar(er)

0 kommentar(er)